A Chapter 13 bankruptcy calculator helps you estimate the 3 or 5 year wage earner’s plan. It is for regular earners to pay some of the debt in a Chapter 13 repayment plan. The bankruptcy court attempts to distinguish what your disposable income is each month to pay back your debt through the plan. The Chapter 13 calculator below mirrors the Chapter 13 calculation of disposable income bankruptcy form, which is used to help determine the Chapter 13 plan payment.

The Chapter 13 calculator below helps estimate a Chapter 13 repayment plan in 2024. We have run the calculation results below against an actual repayment plan and found that the calculations below are quite accurate. That said, the results from the calculator below should still be taken as an estimate.

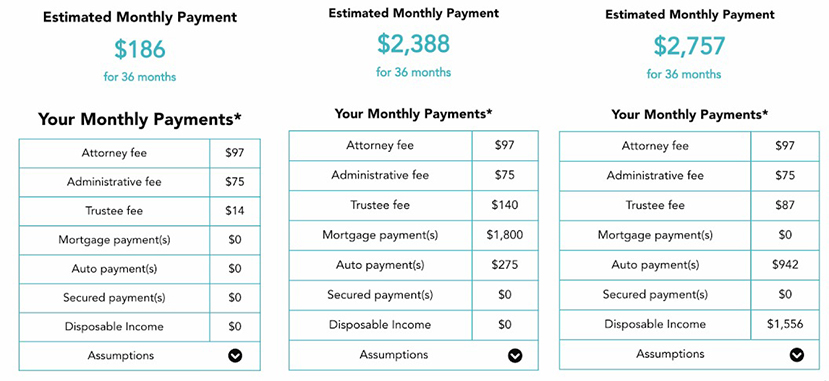

Chapter 13 Plan Payment Examples

To illustrate the differences between Chapter 13 calculator results, we provided 3 recent Chapter 13 plan payment examples that show you how Chapter 13 plan payments can be different. Let’s cover the examples from left to right.

- You’ll notice that the far left example is the smallest payment due to the individual not having real assets nor disposable income. This can often happen when someone files a Chapter 13 after a Chapter 7.

- The middle example has a plan payment that is higher, mainly due to the mortgage payment and auto payment that is included in the plan.

- The far-right example has the highest plan payment because of the auto payment and the disposable income based on the Chapter 13 calculation. There’s also instances where you would have a 100% plan where you pay back 100% of your unsecured debt.

Understand Your Chapter 13 Minimum Plan Payment

Ascend’s minimum payment Chapter 13 calculator computes a Chapter 13 plan payment estimate. The output does not consider disposable income, non-exempt assets, or other pertinent pieces of financial information. Your plan payment may be significantly higher if you have disposable income or assets that are not considered in the rough estimate.

Debts in Arrears:

- Real Estate Debt: Total past due on the mortgage and total past due on 2nd mortgage.

- Automobile Debt: Total past due on 1st and 2nd auto loan or fair market value.

- Other Debt: Balance on loans secured by personal property and Tax debt owed to IRS, state, school or local, the balance of alimony and child support.

Calculator does not consider:

- The total amount of claim for death or personal injury arising out of driving under the influence

- The total amount of other less common priority debt as seen in bankruptcy schedule E

- Married filers

Calculator assumptions:

- Trustee fee of 10%

- Legal fees of $3,500

- 60-month plan

- Interest on secured claims

This can be a great 2-minute estimate of what your minimum plan payment may be, but it does not go into as great of detail as the precise estimate.

Understanding the Chapter 13 Repayment Plan

As stated above, the Chapter 13 bankruptcy is the chapter in the bankruptcy code that allows the debtors to pay back a portion of their debts and keep certain property.

In a Chapter 7 bankruptcy, you have the risk of losing assets such as a home or a vehicle if the value you own in that asset is above the homestead exemption or vehicle exemption for your state. In a Chapter 13 bankruptcy, your assets can be protected.

Items you want to keep in a Chapter 13:

- Do you want to keep the house that you own?

- a) If yes, you can keep your home even if you are behind payments as you can catch up on the missed payments during the plan. You can stretch the payments up to the length of the payment plan, which is often up to five years. Stretching your behind payments over the payment plan can be very beneficial, especially when mortgage lenders will not work with you. In fact, it is sometimes even possible to pay your mortgage, catch up on your missed payments, and wipe out the second mortgage together with little or no payment.

- b) If no, you do not have to pay back the missed payments on your mortgage.

- Do you want to keep your car(s)?

- a) If yes, you will pay them off during your plan with the vehicles paid off completely by the end of the plan. One important thing to note is whether you purchased the car more than 2.5 years prior to filing your bankruptcy.

- b) You will pay the balance of the car loan at a lower interest rate if you purchased within the 2.5 years prior to filing. A lower interest rate can be especially helpful if you previously had a high-interest rate auto loan.

- c) You pay the value of the car if it is less than what you owe at a low-interest rate if you purchase more than 2.5 years from filing.

- Do you have personal assets collateralized by a loan that you want to keep?

- In Chapter 13, you would only pay a fraction of what is owed. For example, if you purchased a new living room set for $5,000 and it is now only worth $500, then you would pay the $500 at a low-interest rate.

- Do you want to keep your jewelry?

- For jewelry, you would pay the lesser of what is owed or what the asset is worth if it is greater than 1 year from filing.

Debts you have to pay in a Chapter 13:

- Tax debt owed to IRS, state, school or local: Oftentimes, taxes can be discharged, but you will have to pay the taxes. The benefit is that you will not pay interest or penalties on a tax debt.

- Balance of alimony and child support: There are also times where you may try to catch up on these payments before entering them into the plan. However, these are debts that you are obligated to pay.

Understand When Your Chapter 13 Plan Payment May Be Higher

The minimum payment Chapter 13 Payment Calculator estimate considers the minimum plan payment that you would pay in a Chapter 13 payment plan. Ascend’s precise calculator is a longer calculation. It considers additional factors to calculate a more precise Chapter 13 payment plan estimate because not everyone is eligible to pay the minimum. Additionally, it also allows you to compare your debt relief options.

What are the reasons why your plan payment would be more than the minimum payment? Let’s go through two common reasons why your plan payment would be more costly than the the minimum payment.

You have disposable income:

The bankruptcy court wants you to pay back your creditors. When you say you are unable to do so, the court wants to ensure that you can only pay the minimum plan payment. The court has three forms that are common for Chapter 13 bankruptcy. They determine whether you have disposable income to pay non-priority unsecured creditors.

- The first form is Chapter 13 Calculation of Your Disposable Income. Please see a picture of the form below. This document uses IRS standard and location guidelines to determine whether your income and expenses have room to pay back your creditors.

- The remaining two forms are Schedule I: Your Income (individuals) and Schedule J: Your Expenses. These forms allow you to self-report your actual expenses. Please note that it is important to put actual numbers here. This is because you may have to produce documents for the court to verify what you are claiming.

You have equity in assets that exceed state homestead exemptions:

Most states have exemptions for what property or items are protected from bankruptcy. What is important to note is that each state varies greatly from what is exempt and the amounts of the exemption. If your equity in an asset exceeds the amount that the state allows to exempt, you would be liable to pay for some amount in your plan payment.

These assets include, but are not limited to, a house, a car, an RV, a vacation home, jet skis, etc. You may consider a Chapter 13 if you have significant value in such assets even if you qualify for a Chapter 7 because of the implication of a Chapter 7 liquidation bankruptcy.

Chapter 13 Bankruptcy Alternatives

There are a few alternative options that many folks consider as an alternative to a Chapter 13 bankruptcy.

- Chapter 7 Bankruptcy

- Debt Settlement

- Debt Management

Of course, each option has its own pros and cons and some require qualification. Using a severity spectrum, we estimate the least severe to most severe debt relief options.

Should You Do A Chapter 13 Bankruptcy?

We would love for you to try our free Chapter 13 payment calculator to estimate your Chapter 13 payment plan to understand whether a Chapter 13 bankruptcy may be a good option for you.

There are many considerations to consider whether to pursue a Chapter 13 bankruptcy. Before you sign the dotted line, estimate your Chapter 13 plan payment.

Leave a Reply