How Ascend Bankruptcy Works

Ascend bankruptcy became an expert in all options to get out of debt, so you don’t have to be.

And, we do it all, for free.

Read Our Mission / Meet Our Team

★★★★★

5.0 stars from 280+ reviews

Step 1: You have debt stress.

Your situation is specific and personal. You may feel that there’s too much information, and everyone is just trying to sell you something.

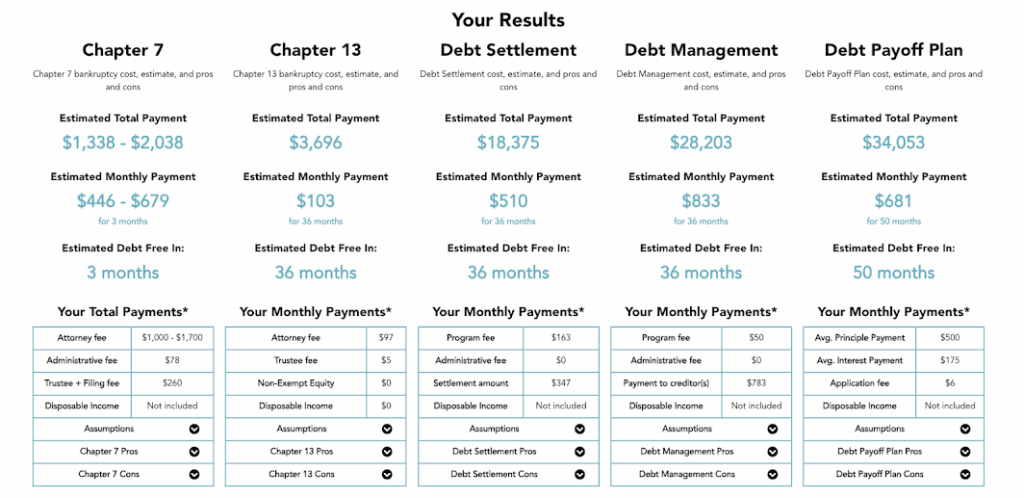

Step 2: You take a free Ascend calculator

If you’re thinking about debt

Most Popular

If you have unique debt case

Step 3: You schedule a free call to go through options.

Schedule Complimentary Evaluation

Don’t worry—you can have as much time as you’d like. 15 minutes is just where we like to start so we can discuss your situation.

There is no limit to the number of calls. Yes, they are always free.

Step 4: We provide a free analysis and send you on your way without ever paying us a dime.

How Ascend Make Money

Since we don’t offer many services ‘in-house,’ we work with a reputable provider network that provides free evaluations to you, but may compensate us for the connection.

And, only 18.9% of those who have taken one of our forms in 2024 to date have actually gotten connected with a service.

We would love to speak with you regardless.

We love this business model, as we can provide 100% free and unbiased calls as we work with a highly rated company for each option:

Step 5: Ascend Bankruptcy’s Mission/Values

Our Mission/Values

Helping you get out of debt cheaper, easier and faster and allowing you to stay out of debt forever.

Our Story

As a child, I watched my family struggle under the burden of unsecured debt, which forced us to live from paycheck to paycheck. Uncertain of how to help, I placed $10 I had earned from my paper route into an envelope and gave it to my mother, hoping it would ease her burden; instead, it brought her to tears.

Growing up, I mistakenly believed that accumulating wealth was the only way to prevent my family from experiencing similar financial stress. I overlooked the core issue: many people lack the knowledge to manage their finances effectively. Coupled with the stigma surrounding discussions about money, this lack of education led to misunderstandings and conflicts in my personal relationships due to differing expectations around saving and spending. To address these challenges, I realized the potential of leveraging data not only to help people get out of debt but also to guide them in maintaining financial stability through effective money management strategies.

And so, we built Ascend Bankruptcy.