One of the most common questions about bankruptcy is, “Do bankruptcies get filed in the newspaper?” or “Who will find out that I filed for bankruptcy relief?”

Individuals may be worried that their names will be printed in the newspaper or appear online after they file for Chapter 13 or Chapter 7 bankruptcy relief. In addition, they worry that their family, friends, employer, coworkers, and others might find out that they had to file bankruptcy to get rid of debts.

It helps to understand what a public record is and how that impacts your bankruptcy case as we discuss whether people will find out you filed for bankruptcy relief.

Do You Need to Worry That People Might Find Out From Newspaper About Your Bankruptcy Filing?

There could be some local newspapers or other sources that publish bankruptcy filings in your area. Because bankruptcy cases are a matter of public record, there is nothing that you can do to prevent someone from accessing your bankruptcy case. However, newspapers rarely publish bankruptcy information for personal Chapter 7 or Chapter 13 cases.

Unless your bankruptcy filing directly impacts a person or company, it is unlikely they will find out about your bankruptcy case unless you tell them. However, if someone is determined to find out if you filed for bankruptcy relief, there are ways for them to locate your bankruptcy records.

Should fear of people finding out about your bankruptcy case prevent you from seeking bankruptcy relief?

It might be embarrassing for a short time if your friends or family members find out you filed for bankruptcy relief. But, in reality, they have their problems and will likely move on to another topic of gossip quickly.

That said, do you know the cost of bankruptcy or whether you qualify? You can estimate cost and qualification using our free Chapter 7 calculator below.

The benefits of filing bankruptcy far outweigh any temporary embarrassment you might feel about filing Chapter 7 or Chapter 13. A bankruptcy discharge gets rid of most of your unsecured debt. Unsecured debts include medical bills, credit cards, personal loans, most personal judgments, and some old personal income tax debts. Depending on your situation, you could get rid of all your debts by filing a bankruptcy case.

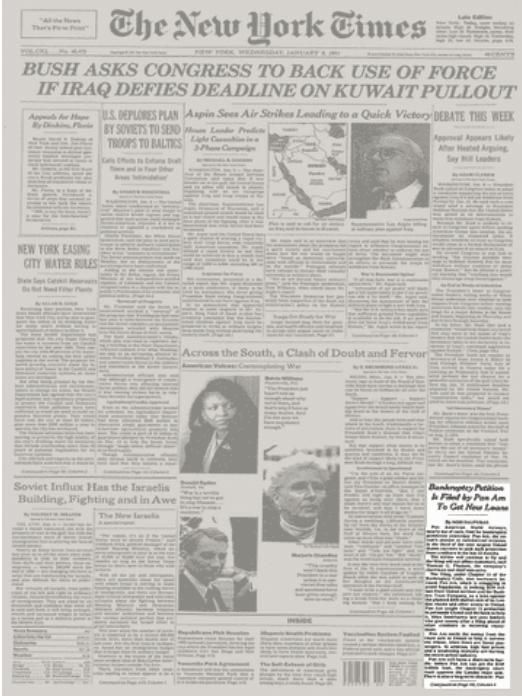

Business bankruptcy filings may be much more common to see in the newspaper. See the image below (source).

Now, let’s talk about public records and how public records work. This is essentially how bankruptcy may show up in a newspaper.

What Is Public Record?

Public records is information, files, documents, and other records maintained by government entities. The information and documents are available for public viewing. Examples of public records include many probate estate records, criminal cases, most civil lawsuits, and real estate records.

Are Bankruptcies Public Records?

Bankruptcy cases are public records. Except for specific redacted information, such as your Social Security Number, your bankruptcy records are a matter of public record. That means that anyone can access and view your bankruptcy filing. They can view the bankruptcy petition, schedules, and statements you file. They can also view other documents filed in your case, such as creditor claims and court orders.

Where Do Bankruptcies Show Up in Public Records?

Because bankruptcy is a matter under federal law, bankruptcy cases are filed in federal bankruptcy courts. Therefore, your bankruptcy case should not appear in your local county courthouse records. Many newspapers that publish “Court News” or recent court cases obtain their information from the county court records. Many newspapers do not print news from federal courts, including bankruptcy courts.

It is important to remember that the bankruptcy court is required to notify specific parties about your bankruptcy filing. The bankruptcy clerk of court mails bankruptcy notices to your creditors, co-signers, and other parties whose rights might be affected by your bankruptcy filing. In Chapter 13 bankruptcy cases, a notice to withhold bankruptcy plan payments from your income (wage withholding orders) may be sent to your employer.

Can You Look Up Bankruptcy Cases Online?

Federal case information is maintained electronically through the Public Access to Court Electronic Records (PACER) system. The PACER system is an internet-based program that allows anyone with an account to search and locate federal court cases, including bankruptcy cases. Individuals may also have access to PACER for filing documents in court cases.

Before someone can use PACER to look up bankruptcy cases, they must register for a PACER account. While it is free to register for a PACER account, there are fees to access court records once you log into a PACER account. Therefore, someone would need to register for an account and pay the fees to search for your bankruptcy case online.

However, someone could also access your bankruptcy case by contacting the bankruptcy court where your case was filed. They would need to provide information to the clerk of the court that allows the court to search for the case. Clerks of courts charge fees for searches and copies of bankruptcy documents.

In some cases, a person could access basic case information (i.e., filing date, chapter of filing, the status of a case, etc.) through the Voice Case Information System (VCIS). Information through VCIS is available 24 hours a day, and the system is free to use.

Some services automatically notify creditors when a consumer who owes them money files for bankruptcy relief. ACCER and Banko are examples of these services. However, individuals and newspapers generally do not pay for these services.

Do You Want Information About Filing Bankruptcy to Get Rid of Debts?

Ascend provides information and resources for individuals who are experiencing debt problems. You can search our library of free bankruptcy articles and explore options to get rid of debt, including filing Chapter 7 and Chapter 13. If you need to talk with a bankruptcy lawyer, we can help you find a bankruptcy lawyer near you that offers free bankruptcy consultations.

Leave a Reply