At this point in your life, surely you’ve heard the delightful little Debt Stopper’s jingle that Debt Stoppers released back in 2015! Like many other jingles, this one could get stuck in my head for days.

But what exactly is Debt Stoppers? In this article, we will look at what Debt Stoppers does, what their clients have to say about their experience, and what alternatives there are to consider. Keep reading to find out more!

What is “Debt Stoppers”?

If you are falling behind on your debt payments and have started looking around to see what your debt relief options are, you may have come across Debt Stoppers. Its slogan is, “A Debt Relief Agency Practicing Bankruptcy Law.” Debt Stoppers is a Bankruptcy Law Firm that has offices spread throughout the United States. From California to Florida, Debt Stoppers advertises a $0 Down Bankruptcy filing and assures you that they can help take care of your debt without putting you in an even worse financial situation. Two of their main offices are located in Atlanta, GA, and Chicago, IL.

Atlanta

There are four Debt Stoppers offices in Georgia, with their primary location sitting in Atlanta. Their offices are now offering free, online consultation meetings that you can set up from the comfort of your own home. You can talk through the process and see if they are a good fit for your situation.

Chicago

With offices throughout Illinois, Debt Stoppers has a headquarters office in the heart of Chicago. So whether you’re inside the loop, or located on the Southside, Debt Stoppers has Chicago covered. They maintain that they are the number 1 rated bankruptcy law firm in Illinois.

Debt Stoppers also has offices in Texas, Florida, Michigan, Nevada, and California, with new offices popping up often. Debt Stoppers claim is simple. They claim to be able to file a bankruptcy on your behalf without you leaving your home. And they also claim that you will not have to put a single dollar down. This includes your bankruptcy filing fees, which can be more than $300.

Debt Stoppers claims are rather large. No money down, never leaving your house, and getting rid of your debt! Those are some big promises. But how accurate are their claims? When you decided to seek out debt relief help, you probably started looking into companies. We want to do that as well. So, in this article, we are going to take a super close look at Debt Stoppers. With thousands of internet reviews, we have placed the most revealing in one article. Hopefully, this will help you decide whether or not Debt Stoppers is right for you.

How much does Debt Stoppers cost?

While Debt Stopper may do a $0 down bankruptcy, how much will filing bankruptcy eventually cost you?

We decided that it would be helpful to build the all-in bankruptcy cost calculator below that’s based on thousands of data points to give you an estimate what bankruptcy will cost you in your city and zip code.

Regardless of when you will need to pay, it’s important to keep in mind that you WILL need to pay at some point. $0 down can be enticing, but don’t let it fool you into thinking you won’t have to pay at all. Let’s take a closer look at how much you can expect to pay for your bankruptcy.

Attorney Fees

Attorney fees vary based on a number of things. Location, case difficulty, case duration, and more can all impact how much your attorney will charge. However, for the most part, we think it is safe to estimate that filing with Debt Stoppers will cost you around $1,500 in attorney fees for a simple Chapter 7 bankruptcy.

Again, this number can change drastically depending on a few different things.

Filing Fees

On top of your attorney fees, you will also have to pay a filing fee. In some cases, Debt Stoppers has claimed you will not have to pay the filing fee up front, but that doesn’t mean you won’t have to pay at all. It simply means you can potentially pay later.

The type of bankruptcy you file for determines the amount owed. If you are filing for a Chapter 13 bankruptcy, the filing fee is $313. It costs $338 to file for Chapter 7 bankruptcy. There are payment plans available through the court. There are also instances where the filing fee may be waived if you make under a certain amount.

Debt Stoppers Reviews

Before moving forward with any company, it’s important to do a little research. The internet is an incredibly useful tool to help you determine how trustworthy a company is. That’s why we have compiled all the reviews you need to see before moving forward with Debt Stoppers. Before we take a look at specific review platforms, let’s get a feel for the general consensus of reviews on Debt Stoppers.

What do the positive reviews say?

Naturally, Debt Stoppers’ website has plenty of glowing reviews listed on each page. From videos to written testimonials, every review on their site is perfect. The reviewers make note of fast, easy, and successful cases. Some even mention the thousands of dollars they saved through Debt Stoppers. Of course, it can be hard to trust reviews on the website of the company, especially when they are all perfect.

So are there positive reviews elsewhere? Fortunately, there are! Both Google and Trustpilot also have plenty of reviewers happy with the service they received. (We will go over those platforms in more detail later.)

What do the negative reviews say?

With all of the positive reviews, can there be any negative reviews? According to multiple different sources, yes, there can be. Aside from Debt Stoppers’ website, every review platform that has positive reviews also has negative reviews.

Most of the complaints center around unmet expectations. Either the reviewer’s case was not handled well, they were not treated with respect, or the outcome they hoped for didn’t happen.

Let’s start taking a look at some specific reviews. We are going to start with Google reviews of two of their main offices: Atlanta and Chicago.

Google reviews Atlanta

Debt Stoppers’ Atlanta office has 224 Google reviews, with an average rating of 4.6 out of 5 stars. The reviews are definitely more positive, however, there is something interesting to note. Not only are there much fewer new reviews, but the majority of the new reviews are also very poor — only one or two stars.

On the positive side, there are many highly rated reviews. A lot of the higher-rated reviews tell of great success stories! The reviewer above noted that, though they were nervous at the thought of filing for bankruptcy, their attorney helped them feel confident and comfortable. They seemed very relieved at the end of their process. Many positive reviews have something similar to say.

On the other hand, there are many negative reviews that warn others to stay away. In this reviewer’s case, she had her car towed because her attorney had not submitted her paperwork on time. Many other negative reviews noted that they felt as though they were just a number and not an individual who needed help.

Many negative reviews also mentioned that Debt Stoppers were money hungry. Some said they were double or tripled charged without receiving a refund. One person even said that Debt Stoppers began pulling twice the agreed-upon amount directly from their paycheck.

Google reviews Chicago

The Chicago Google Reviews are similar. There are 379 reviews, with an average rating of 4 stars out of five. Just as with Atlanta, it appears as though the most recent reviews tend to be more negative than the majority of their older reviews. The positive reviews speak of easy cases, forgiven debt, and fast processes. The negative reviews report rude customer service, unattentive attorneys, and careless mistakes that deeply hurt the reviewer.

Next, we are going to take a look at Trust Pilot.

TrustPilot

TrustPilot has 600 Debt Stoppers reviews on its site. Of the 600 reviews, the average rating is 3.7 out of 5 stars. As always, there is a mix of good and bad reviews.

The above reviewer was incredibly pleased with their service. Their attorney was attentive, hardworking, and made sure the reviewer was comfortable with everything that was going on. Filing for bankruptcy can be a confusing and stressful time, so having an expert who is able to answer your questions is key to staying calm in situations like this.

There are many other positive reviews that assure readers that their case was handled professionally and gave them peace after being overwhelmed with debt.

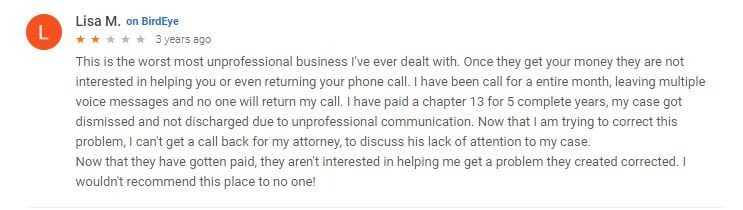

However, there are also many negative reviews. Some negative reviews seem to complain about the bankruptcy process in general, however, some complaints are specific to the company itself.

For example, this reviewer states that working with Debt Stoppers was the worst experience she had ever had. The lack of communication, incorrect information, and disjointed scheduling left this reviewer caught in the middle and unsure of what to do. Unfortunately, this can be one of the biggest factors that can cause a case to be dismissed. If the debtor is absent from multiple meetings, it’s likely that the court will not continue reviewing the case.

The other negative reviews are similar to those found on Google. Either clients complained that too much money was taken from them without warning, or they were unable to contact their attorney once they had signed their papers.

Yelp

While there are only 32 reviews on Debt Stoppers found on Yelp, they are, surprisingly, all pretty negative. Yelp has given Debt Stoppers an average rating of 2 out of 5 stars, based on the reviews left.

Many reviewers complain that, once they signed the papers to work with Debt Stoppers, they weren’t treated as well as they had been. In fact, one person said that, while they could reach their attorney any time before they officially signed their papers, once they signed, they could only get in touch with customer service.

Another reviewer said that the consultation call felt more like a sales pitch rather than an informational and advisement call. They said they felt pressured to sign up to work with them at the end of the call, which made the company feel less like a law firm and more like a bankruptcy business.

There are a few good reviews on Yelp, though not many. The few positive reviews simply state that Debt Stoppers did what they advertised. They filed the bankruptcy, walked the client through the process, and were able to answer questions.

Alternatives

If, while reading through this, you feel as though Debt Stoppers may not be the company you would like to work with, that’s okay! If you are in the position of potentially filing for bankruptcy, YOU are the one who should feel the most comfortable with the people you are working with. Take some time to consider these alternative options.

Using another bankruptcy attorney

Luckily, there are a plethora of attorneys who are able to help you file for bankruptcy. Do some research on attorneys that match up with what you need. Want to be able to meet in person? You can access our local attorney network for a free phone evaluation or you can Google an attorney near you. Want someone to help with a specific or unique issue you have? Find someone who has handled a similar case! There is no shame in shopping around for the attorney that best fits your situation.

Debt management

Have you decided you may not be at the point where you need bankruptcy? Consider debt management. This can help you stay on top of your debt payments without many of the long-lasting impacts bankruptcy or settlements may have.

Debt settlement

If you are far behind on payments, you may be able to reach a debt settlement with your creditors. Sometimes, if a debtor is far enough behind on payments, creditors are willing to accept a lower repayment so that they can recoup at least some of their money. Many companies can help you navigate this as well.

Summary

In all, Debt Stoppers seems as though it is trying to make a business out of filing for bankruptcy. With its offices spread across the nation, the lack of personal communication, and customer service hotlines, there is a chance that you could get lost in the number of clients. While they do seem to deliver on their promise of successfully navigating your bankruptcy case, take a moment to think about how accessible you want your attorney to be. Be sure to read through more reviews on your own to help create a holistic picture of Debt Stoppers. If you’d like to talk to someone about your situation and learn more about your options, feel free to give Ascend a call today!

Leave a Reply