A Chapter 13 bankruptcy trustee is the individual who helps administer your bankruptcy case. Let’s cover some of the individuals involved in the Chapter 13 bankruptcy process:

- A debtor (the person who files the bankruptcy case)

- Creditors

- Bankruptcy trustees

- Bankruptcy judges

- Clerk of court

- United States Trustee’s Office

- Bankruptcy lawyers and creditors’ attorneys

- Co-debtors (people who co-signed debts with the debtor)

One of the most important people involved in your Chapter 13 bankruptcy case is the trustee. Learning more about what the trustee does and their role in your bankruptcy case can help you understand the power a trustee holds over your Chapter 13 bankruptcy case.

What Is a Bankruptcy Trustee?

When you file your Chapter 13 bankruptcy petition, the Bankruptcy Clerk of Court appoints a trustee to your case. The Chapter 13 trustee is a private trustee appointed to administer bankruptcy cases by the United States Trustee.

In addition to overseeing your bankruptcy case, the trustee makes recommendations regarding your case. However, the bankruptcy judge has the ultimate authority to decide disputes or issues within the case.

Even though the trustee cannot act without the court’s approval, it is essential to note the power of the trustee. The judge listens carefully to the recommendations by the Chapter 13 trustee, especially if the debtor does not have a bankruptcy lawyer to argue in favor of the debtor in court.

How Does a Chapter 13 Trustee Get Paid?

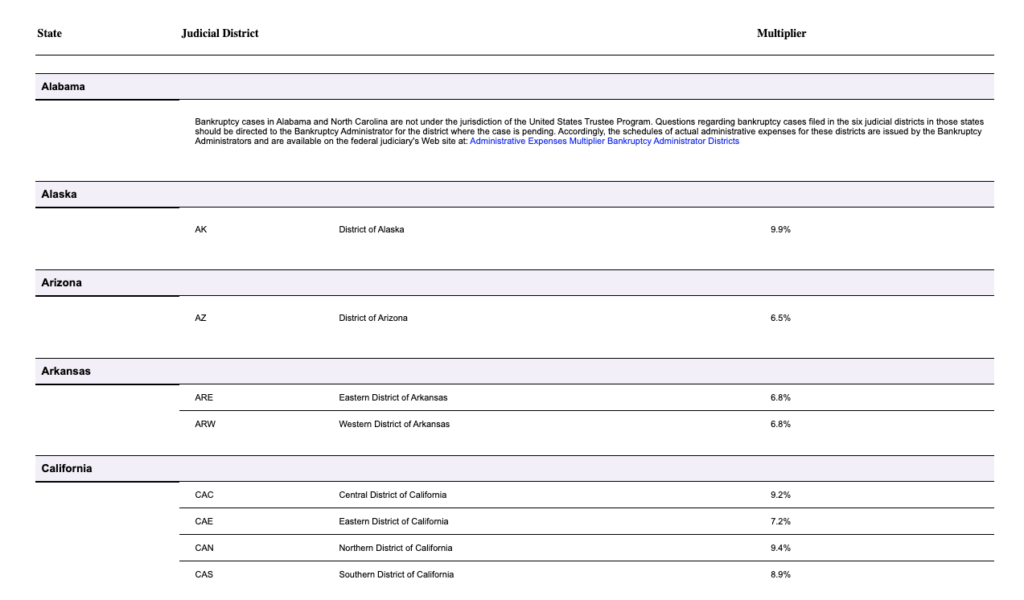

If you look at the administrative expenses on the means-testing website, you can see a range from 3.6% to up to 10% in fees! That can be A LOT of money. We created a Chapter 13 calculator to help you estimate a Chapter 13 plan payment that INCLUDES the Chapter 13 trustee fee payment estimate.

Trustees are paid based on the amount paid under your repayment plan. The percentage may vary based on the jurisdiction, but the maximum percentage for a Chapter 13 trustee fee is 10 percent.

Each month when you make your bankruptcy payment, the trustee deducts the fee percentage from your payment as payment for the trustee’s services.

So, what is the amount that you owe? Unfortunately, the answer is “it depends”. Many factors can change what administrative fees you owe, and there are forms you can look at to figure out the range you may owe. That said, let’s look at some hints and help you estimate your Chapter 13 payment estimate.

If you look at some of the languages on Chapter 13 plans, you see that the trustee gets paid a percentage of the funds received. So, if you are paying more in your plan, you may have a higher Chapter 13 fee.

Chapter 13 Trustee Fee Percentage

We wanted to help you understand exactly what you will pay in trustee fees, so we built a Chapter 13 calculator based on the official US government bankruptcy forms that you can take in the description below.

Here are official Chapter 13 Trustee fees from the government, and here’s a screenshot of the percentages.

Once you see the results, you’ll see a specific section called Trustee Fees that will highlight the estimated Chapter 13 trustee fees in your case.

The Chapter 13 Bankruptcy Trustee’s Role in Your Chapter 13 Case

Your appointed bankruptcy trustee evaluates your financial affairs. They recommend things to the court and administer your case. Your bankruptcy “estate” is all of your legal or equitable interests in property owned at the time of your bankruptcy filing.

The Chapter 13 trustee plays a vital role in your case. They perform the following tasks.

Chapter 13 Bankruptcy Petition

When you file your Chapter 13 petition and schedules, the Chapter 13 trustee reviews the information contained in the schedules. The trustee may request additional documentation or information based on your petition and schedules.

The trustee uses the information in your schedules to determine whether your Chapter 13 plan meets the applicable bankruptcy laws for a bankruptcy repayment plan. They review your assets, debts, income, expenses, recent financial affairs, and bankruptcy exceptions. The trustee uses this information to calculate your Chapter 13 plan.

Chapter 13 Bankruptcy Repayment Plan

The Chapter 13 trustee reviews the proposed bankruptcy repayment plan to determine if you met the criteria required for your case. If the Trustee determines that there is a deficiency, they file an objection to the plan with the court. The court hears objections to the Chapter 13 plan during your scheduled Confirmation Hearing.

In most cases, your bankruptcy lawyer files amended schedules and amended plan to correct the deficiency. Your Chapter 13 plan payment could increase slightly because of the trustee’s objection. Most bankruptcy lawyers propose the lowest plan payment they believe the court will approve. If the trustee objects, the bankruptcy lawyer negotiates to resolve the object in the debtor’s best interests.

If there are no issues, the court generally approves the proposed Chapter 13 plan. However, the court may dismiss your case if you do not resolve deficiencies.

341 First Meeting of the Creditors

The Chapter 13 trustee conducts the First Meeting of Creditors. The debtors must appear and testify at the 341 Meeting. Creditors may also appear at the meeting and ask the debtor questions about their finances.

The trustee verifies your identity, places you under oath, and asks questions about your finances. The questions the trustee asks relate to your plan of reorganization, assets, income, expenses, and debts. You should have already answered these questions by completing your Chapter 13 petition and schedules. Hearings last about 10 minutes, but could take a little longer for complicated cases.

Reviewing Filed Claims

Creditors must file a proof of claim to receive payment from your Chapter 13 case, even if the creditor has a secured claim and should receive specific monthly payments according to the plan. The trustee will not make payments to a creditor without a correctly filed proof of claim.

A bankruptcy trustee may file an objection to a proof of claim, but it is the debtor’s responsibility to review each claim and object to claims. If a secured creditor does not file a claim, the debtor should contact the creditor to ensure the creditor files a timely claim form with the court. The debtor’s bankruptcy lawyer typically takes care of this task.

Administration of the Repayment Plan

The Chapter 13 trustee receives your plan payments from your employer if you participate in wage withholding for bankruptcy plan payments. If you do not have a wage order in place, you are responsible for sending the trustee your plan payment each month before the due date. The trustee petitions the court to dismiss your case if you fall behind on plan payments.

The trustee’s office pays creditors based on the terms of your Chapter 13 plan. Remember, only creditors that file a timely proof of claim receive payments each month. Periodically, the Chapter 13 trustee’s office conducts audits and prepares reports to ensure that all funds received in your case are being paid according to your plan.

During your Chapter 13 case, the trustee may request copies of your tax returns to verify ongoing income. If your income increases significantly during your Chapter 13 case, the trustee could request an increase in your plan payments.

Throughout your Chapter 13 case, the trustee monitors your case for feasibility. If a large claim is filed, the Chapter 13 trustee may determine that the confirmed plan does not work. They will notify you and your bankruptcy lawyer that an amended plan is necessary. If you do not address the situation to the satisfaction of the Chapter 13 trustee and the court, the court may dismiss your Chapter 13 case.

Final Audit and Closing of the Case

When you complete all payments for your Chapter 13 repayment plan, the Chapter 13 trustee completes a final audit of the case. The audit ensures that all funds paid to the trustee were distributed according to the plan. The trustee must account for every penny received during your case, and the audit must balance to zero.

After the audit is complete, the Chapter 13 trustee files documents with the bankruptcy court stating that you made all payments and your case is ready to be discharged. However, the audit process could take several weeks to complete, so your Chapter 13 case may not be discharged and closed until a few months after you make your final payment.

Would you Like to Learn More About Chapter 13 Bankruptcy?

Ascend is committed to assisting individuals with debt problems. We understand how stressful it is to deal with creditors when you do not have the money to pay them.

Leave a Reply